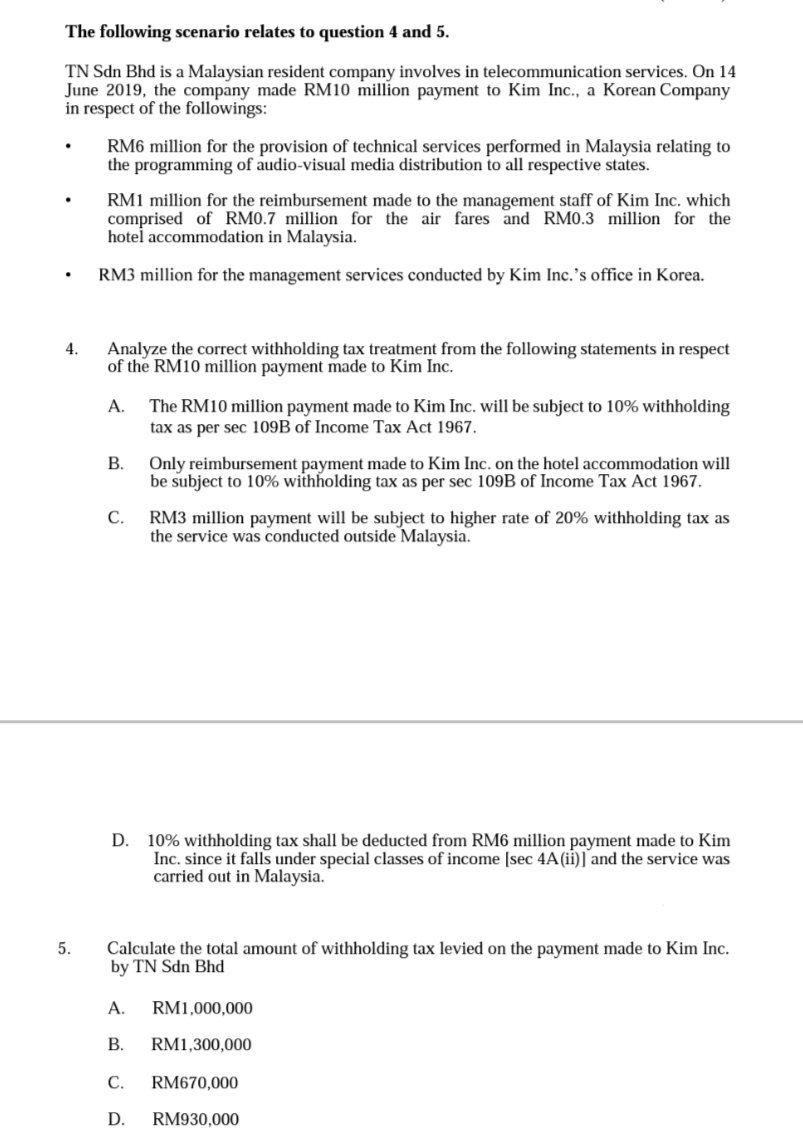

Income that a non-resident derives from Malaysia from special classes of income is subject to tax in Malaysia. The tax measures in the Finance Act are substantially similar to the tax provisions as provided in the Finance Bill 2021 November 2021 including.

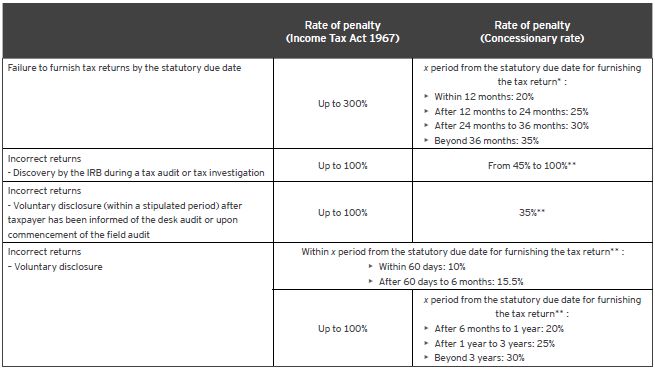

Be Tax Confident Operational Guideline No 3 2020 Penalties Under Section 112 3 Income Tax Act 1967 Section 51 3 Petroleum Income Tax Act 1967 And Section 29 3 Real Property Gains Tax 1976 To Download

Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or.

. Deduction of tax from interest paid to a resident 109D. The prevailing WHT rate is 10 except where a lower rate is provided in an. Guidelines For Income Tax Treatment Of Malaysian Financial Reporting Standards MFRS 5.

LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax. For both resident and non-resident companies corporate income tax CIT is imposed on income. Khamis Mac 10 2016 INCOME TAX EXEMPTION A.

The ordinance was repealed by the Income Tax Act 1967 which took effect on 1 January 1968 and since then further tax legislation has been introduced. The Income Tax Act 1967 in its current form 1 January 2006 consists of 10 Parts containing 156 sections and 9 schedules including 77 amendments. Section 109 1 of the ITA requires withholding tax to be deducted from interest payments derived from Malaysia and payable to a non-resident.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income will be reduced to RM34500. This booklet also incorporates in coloured italics the 2023. The Inland Revenue Board of Malaysia IRBM is one of the main revenue.

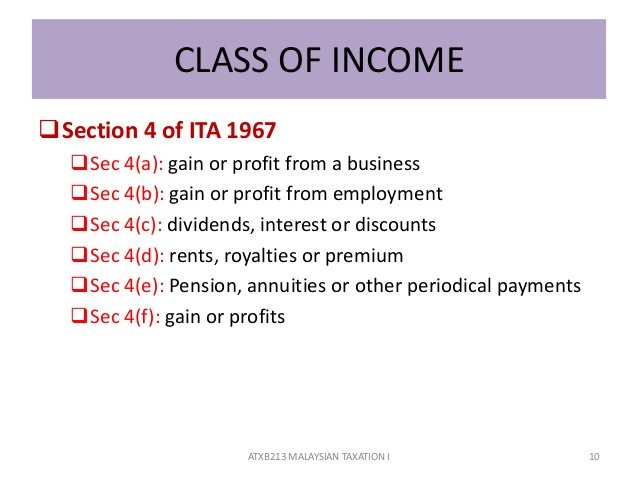

As such theres no better time for a refresher course on how to lower your chargeable. FINANCE ACT 2021 An Act to amend the Income Tax Act 1967 the Real Property Gains Tax Act 1976 the Stamp Act 1949 the Petroleum Income Tax Act 1967 the Labuan Business Activity. Section 3 of the Income Tax Act 1967 ITA states that income shall be charged for the income of any person accruing in or derived from Malaysia or received in Malaysia from outside.

This page is currently under maintenance. Malaysias tax season is back with businesses preparing to file their income tax returns. Employers Responsibility under the Income Tax Act Key Takeaway To inform IRBM any new employee within 30 days.

The Income Tax Act 1967 ITA enforces administration and collection of income tax on persons and taxable income. This enables you to drop down a tax bracket lower your. Reference to the updated Income Tax Act 1967 which incorporates the latest amendments last updated 1 March 2021 made by Finance Act 2017.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Last reviewed - 13 June 2022. Repeal of income tax.

The income tax act 1967 provides that where a person referred herein as payer is liable to make payment as listed below other than income of non-resident public entertainers to a non. And extended to its offices or related. Approved ServicesProjectsASP-Section 127.

Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and. The tax rate payable on. For husbands paying alimony to a former wife the.

Non-Current Assets Held for Sale and Discontinued Operations. Average Lending Rate Bank Negara Malaysia Schedule Section 140B. You cannot claim this if your spouse has a gross income exceeding RM4000 derived from sources outside of Malaysia.

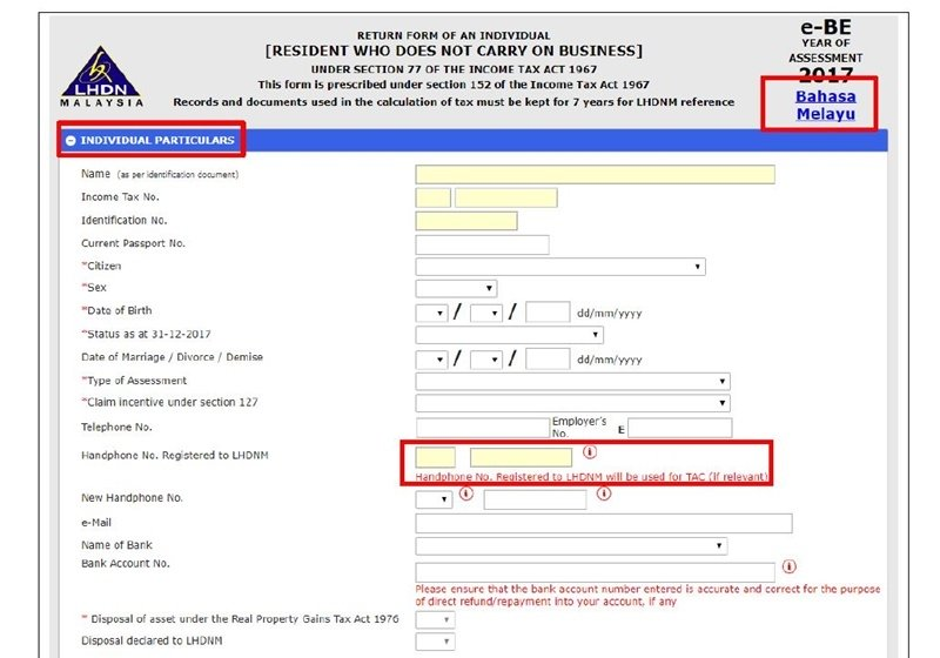

Under Part II Section 7 of the Income Tax Act 1967 the Malaysian government considers any individual regardless of their nationality a tax resident if the individual. Deduction of tax on the distribution of. Income Tax Act 1967 Kemaskini pada.

This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices. To inform IRBM the cessationretirementdeath of an employee. Corporate - Taxes on corporate income.

Deduction of tax from special classes of income in certain cases derived from Malaysia 109C.

Mybuku Com Income Tax Act 1967 Act 53 9789678927703 Ilbs Shopee Malaysia

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

/TermDefinitions_Incometax_finalv1-2c3f527bde3a41c296b6389fda05101d.png)

What Is Income Tax And How Are Different Types Calculated

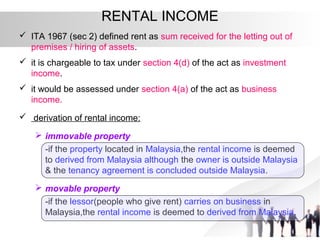

Taxation Principles Dividend Interest Rental Royalty And Other So

Answered The Following Scenario Relates To Bartleby

Set Off Or Carry Forward Of Losses In Income Tax Act Youtube

Tax And Investments In Malaysia Crowe Malaysia Plt

Pr Tax Treatment Of Legal Professional Expenses Income Tax Act 1967 Rules Pdf4pro

Complexity Of The Malaysian Income Tax Act 1967 Readability Assessment Topic Of Research Paper In Economics And Business Download Scholarly Article Pdf And Read For Free On Cyberleninka Open Science Hub

Malaysia Personal Income Tax Guide 2020 Ya 2019

Tax Amnesty Waiver And Remission Of Tax Penalty Withholding Tax Malaysia

Legally Yours Can Cryptos Be Taxed Steemit

Pdf Transfer Pricing Guidelines Puri Prawito Academia Edu

Taxation Principles Dividend Interest Rental Royalty And Other So

Income Tax Act 1967 Hobbies Toys Books Magazines Textbooks On Carousell

Income Tax Act Of Malaysia Apk Voor Android Download

Malaysia Personal Income Tax Guide 2021 Ya 2020

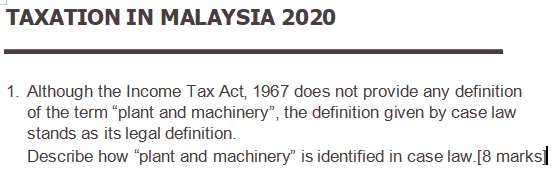

Solved Taxation In Malaysia 2020 1 Although The Income Tax Chegg Com

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel